On 22 March the Federal Government announced a package of temporary superannuation measures which reflect the strength of the super system and the fact it was built for the wellbeing and livelihoods of Australians.

The temporary measures for people facing significant financial hardship as a result of the coronavirus include:

-

early release of a limited amount of superannuation for individuals in extreme financial stress, and

-

reduction in minimum superannuation drawdown rates for retirees.

It’s a pragmatic and caring move for a nation under stress. You can find more detail on these measures below.

Now, as always, we recommend you contact us on Phone 02 9279 2001

What has the Federal Government announced?

On 22 March 2020, the Federal Treasurer announced temporary changes to super for people facing financial hardship as a result of the Coronavirus. This is part of the Government’s Economic Response to the Coronavirus.

The measures include:

-

Temporary early access to super

Eligible individuals will be allowed early access to super of up to $10,000 before 1 July 2020 and up to a further $10,000 from 1 July 2020. Meaning, if eligible, you may be able to access up to $20,000 overall.

-

Providing support for retirees

There will be a temporary reduction in the minimum annual amount that you’re required to withdraw from your super income stream. The reduction in the minimum drawdown rates will apply for this financial year and for the 2020/21 financial year.

Am I eligible to access my super under the Government’s new temporary rules?

To be eligible for early release of super you must satisfy any one of the following requirements:

-

You are unemployed.

-

You are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance.

-

On or after 1 January 2020:

– you were made redundant

– your working hours were reduced by 20% or more, or

– if you’re a sole trader your business was suspended or there was a reduction in your turnover of 20% or more.

These payments will be tax-free and won’t be assessable when determining your entitlement to Centrelink or Department of Veterans’ Affairs entitlements.

How do I apply?

You can apply directly to the ATO through your MyGov account at my.gov.au To apply, you’ll need to meet the eligibility criteria.

After the ATO has processed your application, they’ll issue you with a determination. The ATO will also provide a copy of this determination to your superannuation fund, which will advise them to release your superannuation payment.

Your fund will then make the payment to you, without you needing to apply with them. To make sure you receive your payment as soon as possible, you should contact your fund to check that they have your correct details—including your current bank account details and proof of identity documents.

Separate arrangements will apply if you’re a member of a self-managed superannuation fund (SMSF).

More information will be available at ato.gov.au

When can I apply?

It is expected that applications can be made from mid-April.

We’ll keep our Coronavirus support page updated as soon as we have more information for you. Visit mlc.com.au/coronavirus

What documents do I need to provide when I apply (ie if I’ve been made redundant or had my hours reduced)?

To find out more about what documents are required, please refer to the application process at my.gov.au

What paperwork will I need to provide MLC to get my payment?

After the ATO has processed your application, they’ll issue you with a determination. The ATO will also provide us with a copy of this determination if you’re a member of our fund, which will direct us to release your superannuation payment.

We’ll then make the payment to you, without you needing to apply to us directly. The speed at which we can make the payment to you is reliant on us having up-to-date information for you, including your bank account and contact details, and proof of identity documents.

Where can I find more information about this?

For more information on the Australian Government’s Economic Response to the Coronavirus, visit treasury.gov.au/coronavirus

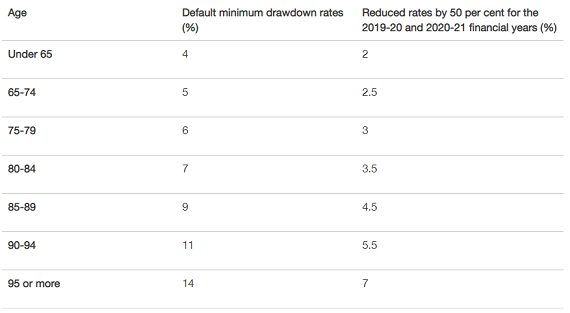

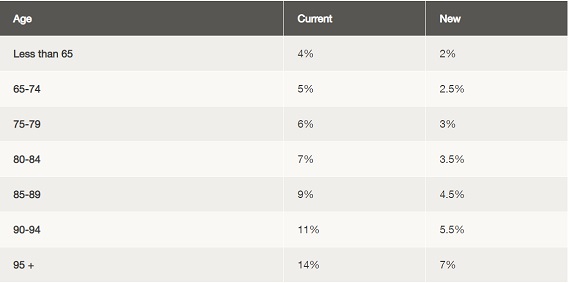

What are the new rules around the reduction in drawdown requirements for account-based pensions?

The Government is temporarily reducing minimum drawdown requirements for account-based pensions and similar products by 50% for the 2019/20 and 2020/21 financial years.

Am I eligible to reduce my minimum pension payment amount?

Yes. This is available to everyone with an account-based pension.

Temporary early access to super

Impacted individuals will be allowed early access to their super of up to $10,000 before 1 July 2020 and up to a further $10,000 from 1 July 2020.

It is expected that applications can be made from mid April.

These payments will be tax-free and won’t be assessable when determining your entitlement to Centrelink or Department of Veterans’ Affairs entitlements. Eligible individuals will be able to apply to access funds under this condition of release at my.gov.au

To be eligible, individuals must satisfy any one of the following requirements:

-

They will be unemployed

-

They’re eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), or a special benefit or farm household allowance

-

On or after 1 January 2020:

-

they were made redundant

their working hours were reduced by 20% or more

they’re a sole trader whose business was suspended or has a reduction in turnover of 20% or more.

You can find more information about this measure and the Government’s Economic Response to the Coronavirus at treasury.gov.au/coronavirus

Providing support for retirees

There will be a temporary reduction in the minimum annual amount that you’re required to withdraw from your super income stream. The reduction in the minimum drawdown rates will apply for this financial year, and for the 2020/21 financial year.

You can find more information about this measure and the Government’s Economic Response to the Coronavirus at treasury.gov.au/coronavirus

Please contact us on Phone 02 9279 2001 if you would like to discuss.